Renters Insurance in and around Long Beach

Looking for renters insurance in Long Beach?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

There’s No Place Like Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented space or townhouse, renters insurance can be the right next step to protect your personal items, including your boots, smartphone, furniture, tablet, and more.

Looking for renters insurance in Long Beach?

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

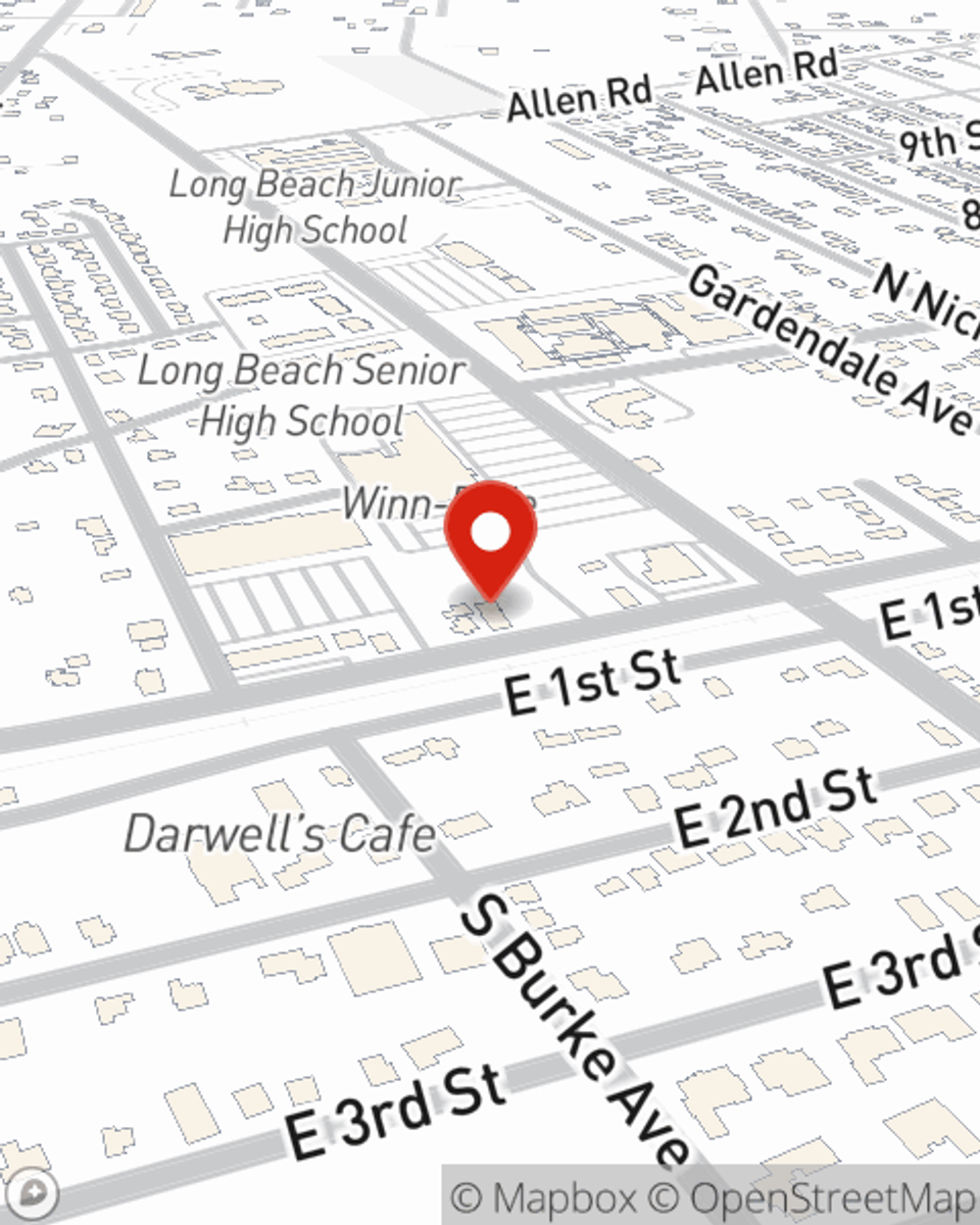

When renting makes the most sense for you, State Farm can help insure what you do own. State Farm agent Elvis Gates Jr can help you with a plan for when the unpredictable, like an accident or a water leak, affects your personal belongings.

There's no better time than the present! Get in touch with Elvis Gates Jr's office today to learn more about State Farm's coverage and savings options.

Have More Questions About Renters Insurance?

Call Elvis at (228) 864-6323 or visit our FAQ page.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Elvis Gates Jr

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.